az auto sales tax

The effective state sales tax in Arizona is 56. The construction transaction privilege tax sales tax rate also increased by 025 percent for.

Arizona Vehicle Sales Tax Fees Calculator Find The Best Car Price

Casa Grande AZ Sales Tax Rate.

. In Arizona the sales tax for cars is 56 but some counties charge an additional 07. Welcome to A Z Motors in Clute TX. What Transactions Are Subject To The Sales Tax In Arizona The Arizona sales tax rate is currently.

42-5159A2 and MCTC Sec. The arizona state sales tax rate is 56 and the average az sales tax after local surtaxes is 817. All used and new car purchases in Arizona have the statewide sales tax of 56 applied to them.

Download User Guide Go To Calculator. Casas Adobes AZ Sales Tax Rate. The Vehicle Use Tax Calculator developed and implemented by the Arizona Department of Revenue ADOR is a tool that provides that convenience with a one-stop shop experience.

The minimum combined 2022 sales tax rate for Flagstaff Arizona is. County or local sales tax is specific to each area within Arizona and thats tacked on in addition to the statewide rate. AvaTax delivers real-time sales tax rates and uses advanced technology to map rates to exact address locations based on the latest jurisdiction requirements.

Flagstaff AZ Sales Tax Rate. And tax reciprocity with Arizona meaning that the nonresidents state will provide a credit for the Arizona state TPT amount paid by the nonresident purchaser at the time of the sale. For more information on vehicle use tax andor how to use the calculator click on the links below.

The sales tax rate is always 78 Every 2021 combined rates mentioned above are. The following rates apply at the state and city level. Unfortunately the price isnt capped there.

Whether or not you have a trade-in. Buckeye AZ Sales Tax Rate. Main St Suite 450 Mesa AZ 85201.

Avondale AZ Sales Tax Rate. There are a total of 99 local tax jurisdictions across the state collecting an average local tax of 241. Counties and other local jurisdictions can also add a tax rate on top of the states base rate.

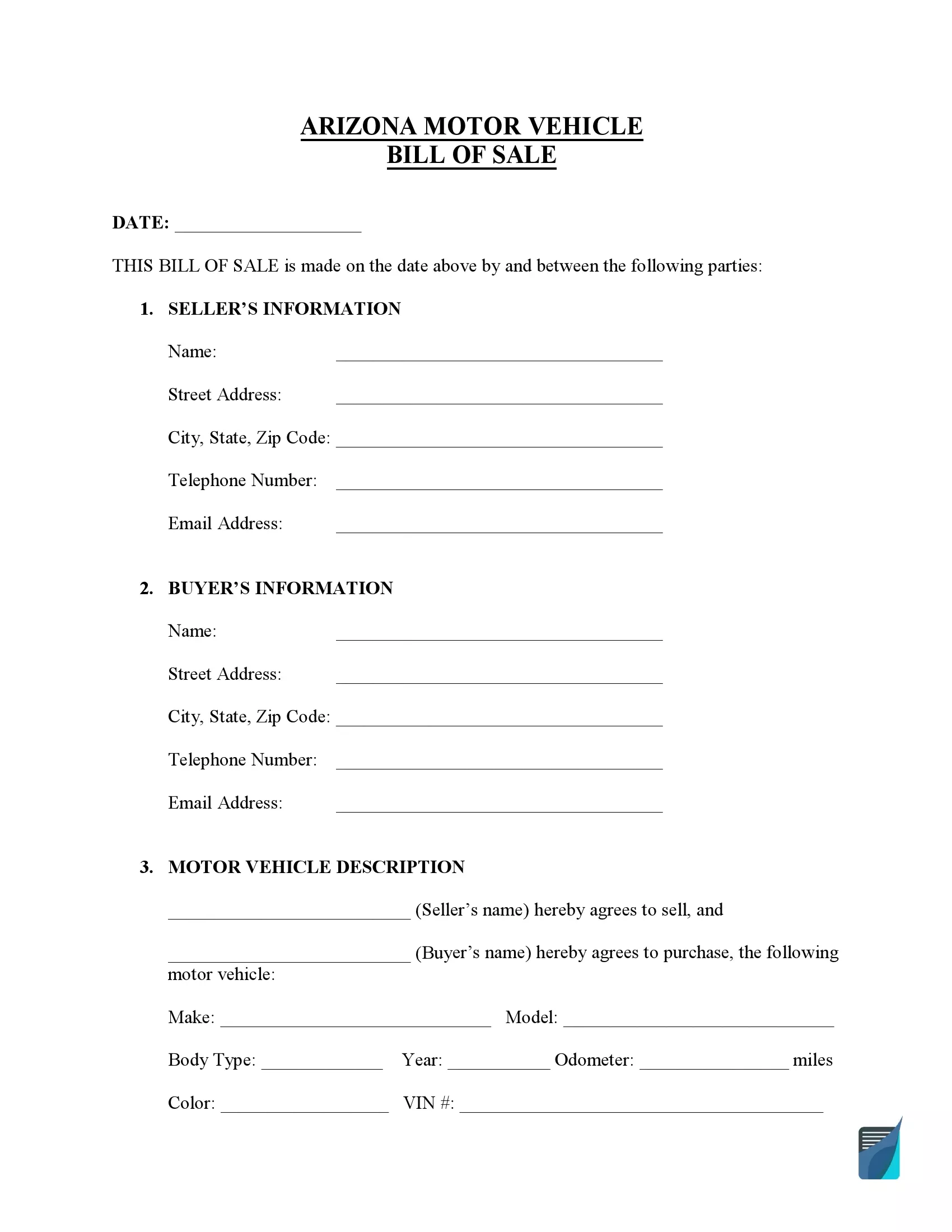

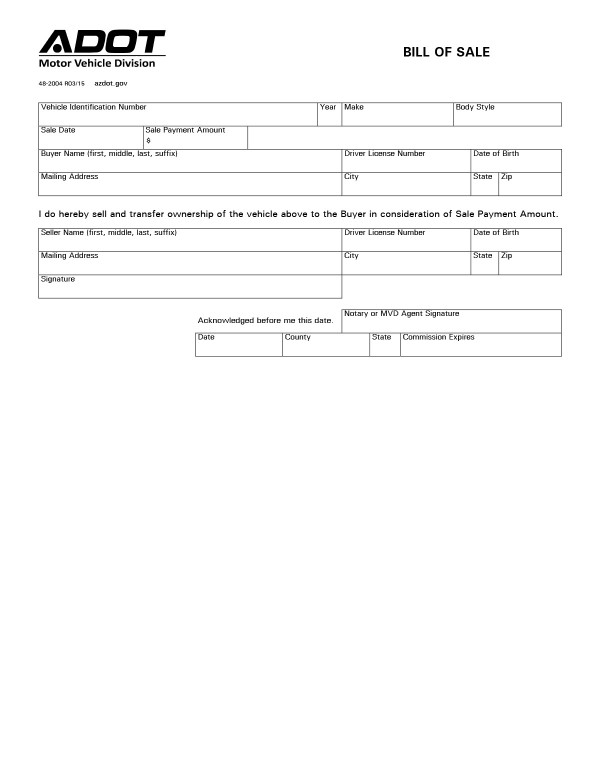

Transaction privilege tax Sales tax The states sales tax base rate is 56 percent. The average sales tax in Arizona is 7732. There is no county use tax in Arizona The bill of sale must include the dealers zip code and the amount of sales tax or excise tax paid.

Arizona collects a 66 state sales tax rate on the purchase of all vehicles. Arizona last updated this percentage in 2013 when it was reduced from 66 to the current rate of 56. Some cities can charge up to 25 on top of that.

There are a number of variable retail sales tax rates in Arizonas counties and cities the three rates combined range between 7-112 total sales tax. The type of license plates requested. Any business that sells products and services must collect the transaction privilege taxes levied by the state and local jurisdictions.

A state use tax or other excise tax rate applicable to vehicle purchases or registrations that is lower than Arizonas 56 percent state transaction privilege tax rate. Total Sales Tax Rate. Chandler AZ Sales Tax Rate.

At A Z Motors we carry only the finest quality used cars trucks and SUVs available in the Clute TX area. Gilbert AZ Sales Tax Rate. County tax can be as high as 07 and city tax can be up to 25.

If the out-of-state tax that you paid is less than the amount of use tax due to Arizona you will owe the difference. The Arizona sales tax rate is currently. The other taxes specific to Arizona are the Title tax of 4 the Plate Transfer tax of 12 and the Registration tax of between 8 and 120.

The state sales tax on a vehicle purchase in the state of Arizona is 56. Price of Accessories Additions Trade-In Value. Yes you will have to pay sales tax on a used car that is purchased through a dealership.

The Tucson sales tax rate is. Our knowledgeable staff is committed to providing you with a no-pressure buying experience. Average Sales Tax With Local.

However this amount does not include local county sales taxes. Tax Paid Out of State. Arizona has state sales tax of 56 and allows local governments to collect a local option sales tax of up to 53.

The Arizona VLT Vehicle License Tax is the major fee among others that you have to pay every 1 to 2 years when you register your gasolinediesel vehicle at the Arizona Division of Motor Vehicles officewebsite or an Authorized Third Party office. We want to make sure you find the vehicle that meets your needs and fits your budget. Automating sales tax compliance can help your business keep compliant with changing sales tax laws in Arizona and beyond.

Do I have to pay sales tax on a used car in Arizona. The Arizona VLT is calculated from the base retail price of the vehicle and the year it was first. Average Sales Tax With Local.

Catalina Foothills AZ Sales Tax Rate. The County sales tax rate is. 1 2007 the transaction privilege tax sales tax rate for the Town of Queen Creek increased by 025 percent for a total sales tax of 225 percent.

However the total tax may be higher depending on the county and city the vehicle is purchased in. This is the total of state county and city sales tax rates. Arizona Sales Tax Rates.

The Flagstaff sales tax rate is. In Arizona certain items may be exempt from the sales tax to all consumers not just tax-exempt purchasers. Bullhead City AZ Sales Tax Rate.

Car Tax By State Usa Manual Car Sales Tax Calculator

2021 Arizona Car Sales Tax Calculator Valley Chevy

How Much Are Tax Title And License Fees In Arizona Mercedes Benz Of Gilbert

How To Sue A Car Dealer For Misrepresentation Findlaw

What S The Car Sales Tax In Each State Find The Best Car Price

Shares Of Ev Start Up Lucid Jump On New Reservations 2022 Production

Nj Car Sales Tax Everything You Need To Know

2021 Arizona Car Sales Tax Calculator Valley Chevy

How To Register A Car In Arizona Metromile

Arizona State Taxes 2021 Income And Sales Tax Rates Bankrate

Car Bill Of Sale Pdf Printable Template As Is Bill Of Sale

Arizona Vehicle Sales Tax Fees Calculator Find The Best Car Price

Berge Volkswagen Will Pay Your Sales Tax Volkswagen Vw Toureg Vw Jetta

Free Arizona Vehicle Bill Of Sale Form Pdf Formspal

Arizona Vehicle Sales Tax Fees Calculator Find The Best Car Price

How To Calculate Sales Tax How To Find Out How Much Sales Tax Sales Tax Calculation Youtube

Nexus Program Tpt Arizona Department Of Revenue

Your Top Vehicle Registration Questions And The Answers Adot

Arizona Bill Of Sale Forms And Requirements For Registration